After much speculation that the chancellor would announce an additional property tax, the new “mansion tax” was unveiled during the November 2025 Budget. Read on to find out whether it’ll affect you, and how the new tax works.

The mansion tax will apply to properties worth more than £2 million in England

Officially called the High Value Council Tax Surcharge, the mansion tax will be applied to most properties that are valued at more than £2 million from 2028. Social housing will be exempt from the tax.

In the Budget document (26 November 2025), the government estimates that the new tax will affect fewer than 1% of properties and will raise £400 million in 2029/30.

The Treasury (26 November 2026) said the introduction of the surcharge will improve fairness within England’s property tax system. It noted: “Under the current system, the average band D charge for a typical family home across England is £2,280. That is £250 more per year than a £10 million property in Mayfair, based on the band H charge in the City of Westminster, currently pays.”

While a relatively small proportion of households will pay the tax, it’s set to disproportionately affect homeowners in London and the south-east. According to a Yahoo article (25 November 2025), estate agent Hamptons estimates that 50% of homes worth more than £2 million are located in London, and 85% are located in the south-east.

The new tax will not automatically apply to properties in Wales, Scotland, or Northern Ireland. Property taxes are a devolved matter, which means each government has the power to set its own system. However, devolved governments may choose to introduce a similar tax.

The mansion tax will be collected alongside Council Tax from 2028

A consultation on the details of the scheme will take place this year, before the tax comes into force in April 2028.

Under current proposals, the tax will be collected alongside Council Tax. However, rather than the money going to local authorities, like Council Tax, it will go to the Treasury.

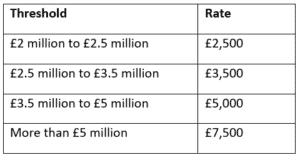

The proposals include four bands.

The tax could significantly affect the budgets of homeowners, who might need to review their finances to account for the additional expense.

It’s expected that properties in the top Council Tax bands (F, G, and H) will be revalued to estimate their current market value, with valuations conducted every five years going forward. As a result, homeowners could unexpectedly find they’re liable for the mansion tax.

Importantly, it is homeowners, not occupiers, who will need to pay the tax. So, if you’re a landlord with a property valued at more than £2 million in your portfolio, you may be liable for the tax.

So far, the government hasn’t revealed further details about reliefs and exemptions, including an appeal system, whether homeowners will be able to defer paying the mansion tax if they’re unable to pay immediately, and the treatment of those who are required to live in a property as a condition of their job. These areas will likely be considered during the consultation period.

The mansion tax could push down property prices at the top of the market

As the mansion tax will only apply to high-value properties, it’s unlikely to have a marked impact on the property market overall. However, it could push down property prices around each mansion tax band boundary to attract potential buyers.

Some homeowners might consider downsizing to avoid the tax altogether. However, Stamp Duty costs may make this option prohibitive for some families.

Contact us to talk about your mortgage options

If you’re searching for a new home, we could help you secure a mortgage. We’ll search the market for a deal that suits your needs, which could help you manage your budget if you need to consider the effects of the mansion tax. Please get in touch to talk about your mortgage.

Please note: This article is for general information only and does not constitute advice. The information is aimed at individuals only.

All information is correct at the time of writing and is subject to change in the future.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.